LumiBit has highlighted one of the potential future directions for Bitcoin Layer 2 (L2) development, outlining possible scenarios for the Bitcoin ecosystem with comprehensive chain ecology and interoperability.

15 years ago, Satoshi Nakamoto published the Bitcoin whitepaper and set the block size limit to 1MB. To this day, block size remains a hotly debated topic among developers. The block size limit caps the amount of transaction data that can be included in each block. As Bitcoin’s application scope expanded, network congestion, increased transaction confirmation times, and rising transaction fees have become recurrent issues.

To address these challenges, the community has proposed various scaling solutions. Some advocate for increasing block size, others suggest optimizing block structure, and still, others believe in the implementation of sidechains and similar technologies. Each of these solutions has its advantages and disadvantages, leading to difficulty in reaching community consensus and even causing divisions.

The recent surge in the popularity of inscriptions has reignited discussions around scaling. Exploring the inscription market, the rapid increase in $LBIT inscription and transaction volume caught attention. All inscriptions were completed in just 2 hours, with gas fees exceeding $600,000. Further investigation revealed that behind this surge was LumiBit, a Bitcoin scaling solution distinct from protocols like the Lightning Network, Stacks, and Liquid Network.

The BTC Nativeness of LumiBit

Bitcoin, as the largest cryptocurrency by consensus, places significant emphasis on trust and decentralization in its Layer 2 solutions. Maintaining Bitcoin’s native characteristics is crucial, as it ensures these Layer 2 solutions are tightly integrated with the Bitcoin community, its core consensus, and principles.

This alignment fosters greater trust, security, and decentralization. Only by preserving the nativeness, while offering faster transaction speeds and lower fees, can Layer 2 solutions expand Bitcoin’s functionality and application scope. Straying from Bitcoin’s native characteristics risks distancing a Layer 2 solution from the Bitcoin community and its foundational consensus. Such a divergence could potentially lead to an unsustainable path for Layer 2 development.

Trust in Layer 2 solutions isn’t solely based on their technical merits, but rather on their connection and interaction with the main chain. The crux of this trust lies in the ability of Layer 2 data to be stored and verified on the main chain. With this in mind, LumiBit’s strategy goes beyond just earning trust in its own data processing capabilities. It aims to gain user trust by ensuring honesty and transparency in data transmission.

This honesty and transparency are verifiable and repeatedly so, with the reliability of its data underpinned by the Bitcoin network.

LumiBit is dedicated to reintegrating more verifiable information into the BTC mainnet and enhancing its collaboration with Bitcoin mining pools to strengthen its nativeness as a BTC Layer 2 solution. Through this approach, LumiBit not only fully respects and utilizes Bitcoin’s inherent characteristics but also ensures the credibility and transparency of data on the LumiBit chain.

LumiBit’s strategic design for maintaining Bitcoin’s nativeness encompasses a comprehensive cycle structure for users, ranging from cross-chain processes and execution to Data Availability

- UTXO Channel Bridge

This bridge conceptualizes the cross-chain interaction between users and LumiBit as a unique channel. The process of validating this channel equates to confirming the legitimacy of the user’s cross-chain actions. Additionally, the validation process is integrated into UTXO, meaning that the validation of the channel simultaneously verifies the user’s status on LumiBit, ensuring a seamless and secure cross-chain experience.

- Inscription-based Execution

LumiBit enables users to interact with Bitcoin’s native features through inscriptions. All user data is stored on the BTC mainnet and transactions are executed via inscription.

To publish a transaction, users simply need to inscribe the message and broadcast it over the BTC network. Once confirmed by the BTC network, LumiBit proceeds to execute and settle the transaction on the LumiBit network. This approach facilitates a seamless integration of Bitcoin’s core functionalities with LumiBit’s Layer 2 capabilities.

- Bitcoin as DA

One of the challenges facing data availability (DA) in Bitcoin Layer 2 is how to upload, publish, and verify information in an affordable and effective manner on the Bitcoin mainnet. Since rollup transactions are sent to Bitcoin in an aggregated form and Bitcoin has very limited block capacity, rollups must utilize more efficient data compression and proof verification methods. LumiBit employs the Halo2 zero-knowledge proof scheme to generate validity proofs for transactions.

After executing user transactions, ZK-EVM produces zero-knowledge proofs for each state change of the transaction. Importantly, these proofs are only generated if the transaction is valid and executable. By shifting calculation and proof generation off-chain, LumiBit not only reduces the cost of data storage on the Bitcoin mainnet but also decreases the transaction costs for users on Layer 2.

The History of Scaling Bitcoin: The Arrival of Type2 ZK-EVM

Previously, the common scaling solution of Bitcoin included state channels and sidechains.

In 2015, Joseph Poon and Thaddeus Dryja introduced the Lightning Network, a network based on payment channels. Users could conduct fast, low-cost Bitcoin transfers off-chain, with on-chain transactions only needed when opening or closing channels. Currently, there are approximately 5,000 BTC in the Lightning Network.

State channels like the Lightning Network also have several drawbacks, such as an inability to handle complex contract computations, risks associated with fund locking and security, and a failure to provide a thriving on-chain ecosystem for Bitcoin. Subsequently, Bitcoin sidechains like Liquid Network and Rootstock emerged, operating parallel to the Bitcoin mainnet and communicating with Bitcoin through two-way bridges.

However, these sidechains have independent consensus rules and data storage structures. Their Data Availability (DA) is not guaranteed by the Bitcoin network, posing certain risks to user assets in extreme cases.

In contrast, Ethereum’s scaling market is rapidly evolving. Ethereum’s mainstream scaling solution adopts Rollup Layer2. According to L2BEAT data, Ethereum’s Layer2 Total Value Locked (TVL) has surpassed $22.5 billion.

Bankless co-founder David Hoffman once stated that the era of EVM equivalence has arrived. When David made this statement, he probably did not foresee that Bitcoin might also enter an era of EVM equivalence, capturing the ecological value of Ethereum.

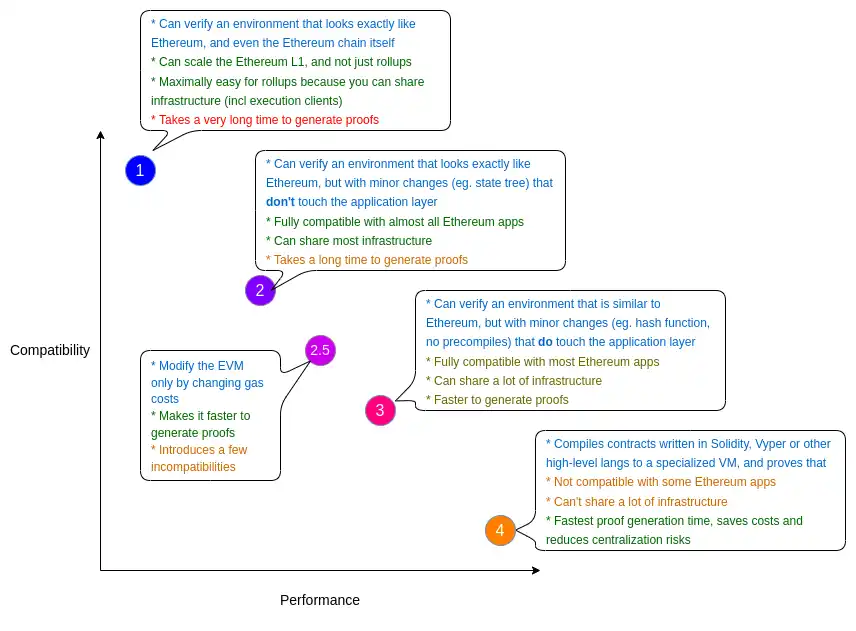

LumiBit is a new Bitcoin Layer 2 solution, achieving low cost, high performance, and fast transaction confirmations through ZK-Rollup. LumiBit adopts Scroll’s technical solution, which is a Type2 ZK-EVM, considered fully equivalent to EVM. Vitalik Buterin classified ZK-EVM into four types in his paper. Type2 is fully compatible with EVM, with transaction execution and account logic consistent with EVM, differing only in block structure and state tree from Ethereum.

LumiBit’s Type2 ZK-EVM, based on a universal circuit design, ensures full compatibility with the Ethereum ecosystem at the EVM layer. It adopts a state tree update scheme more aligned with Bitcoin’s UTXO model, considering the differences in state between Bitcoin and Ethereum.

Moreover, Bitcoin serves as the Data Availability (DA) layer, where users’ transactions, historical transaction states of LumiBit, and global account states are packed with corresponding root proofs generated by a zero-knowledge proof generator and then sent back to the Bitcoin mainnet. The vast computational power of the Bitcoin network ensures the security of LumiBit’s Layer 2.

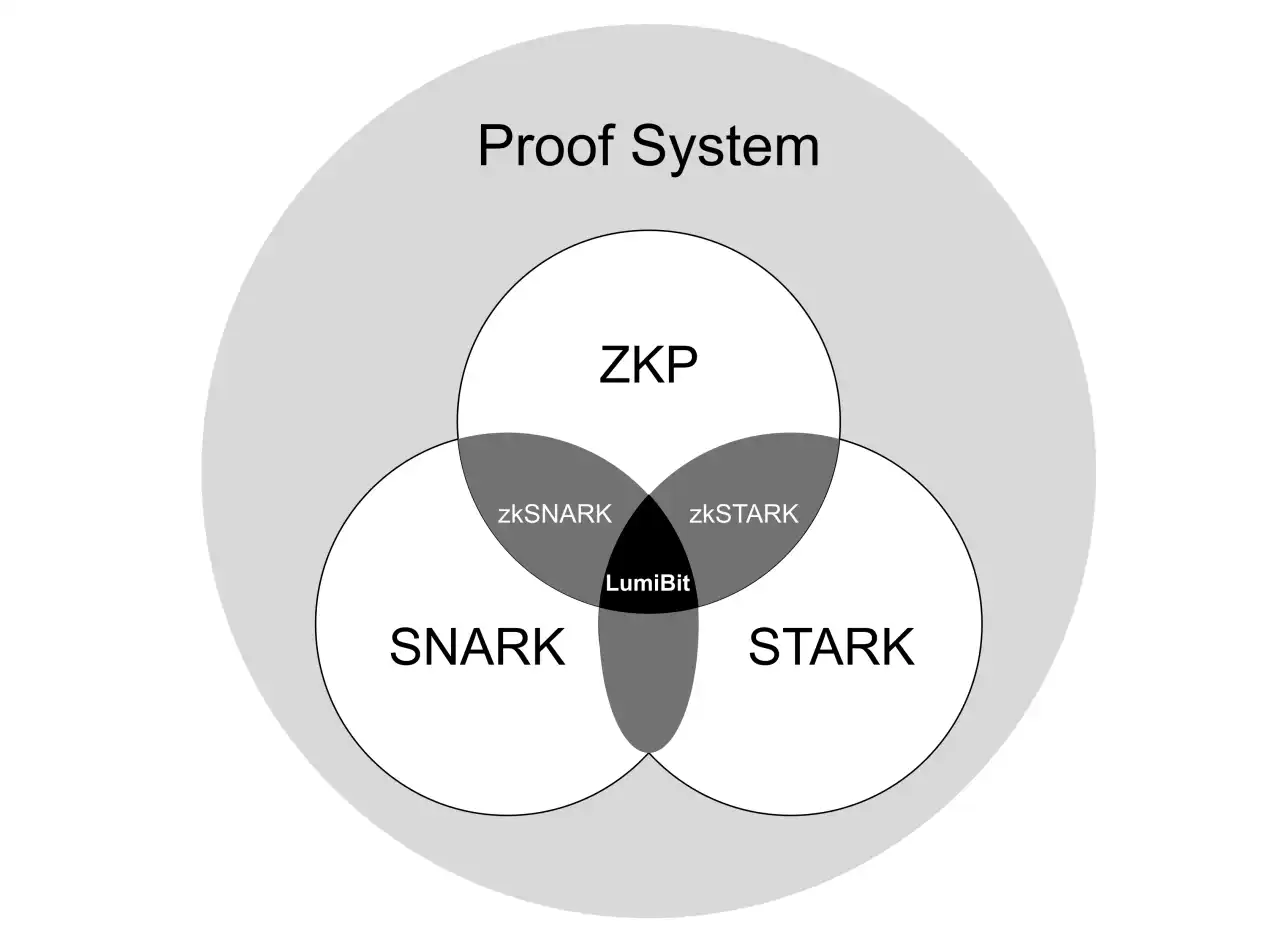

Distinct from similar ZK-Rollups, LumiBit’s uniqueness lies in its transaction zero-knowledge proofs generated based on Halo2 + FRI, along with polynomial commitments to reduce verification costs.

Halo2 is a zero-knowledge proof system, part of zk-SNARK, used for creating concise non-interactive proofs to validate transaction authenticity. FRI, part of the STARK proof system, is utilized to construct and verify proofs about complex polynomial data. This means LumiBit integrates the advantages of both STARK and SNARK technologies.

Currently, Type2 ZK-EVM stands as one of the market-leading solutions, yet there remains a gap to achieving a native Ethereum environment. To ensure a 100% migration of the entire Ethereum ecosystem, it’s necessary to develop Type1 ZK-EVM, which would be fully equivalent to Ethereum.

LumiBit, building upon the foundation of Type2 ZK-EVM, has proposed a concept for Type1 ZK-EVM. This involves abstracting an additional layer of Type1 ZK-EVM on Layer 2, where the results of the transactions are relayed back to Type2 ZK-EVM, and then LumiBit updates these states to the Bitcoin network. This three-layer structure aims to indirectly implement Type1 ZK-EVM.

On the Cusp of the Bitcoin Ecosystem Explosion

Beyond offering Bitcoin a scaling solution, LumiBit also aims to revolutionize the current market for inscription trading.

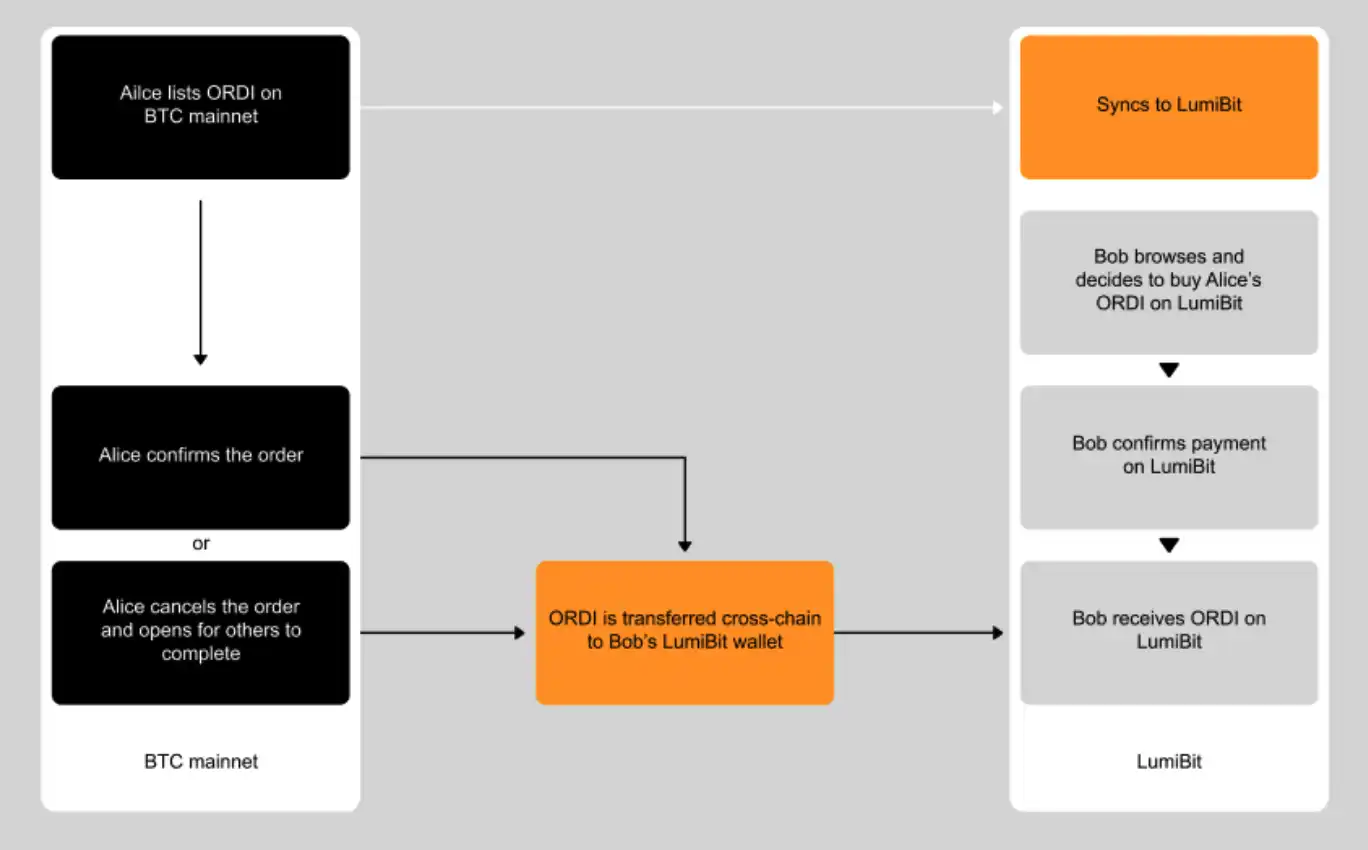

In the current market, the process of trading Bitcoin inscriptions on Layer 2 is quite cumbersome and complex, requiring frequent cross-chain transactions between the main chain and Layer 2. Additionally, the liquidity of funds is rather dispersed, leading to low utilization rates.

LumiBit is addressing this issue through an asynchronous structure built on two mechanisms: real-time cross-chain communication and separate cross-chain transactions.

Real-time cross-chain communication ensures that communications on LumiBit remain in sync with the BTC main chain. Moreover, LumiBit’s built-in indexers and listeners can read the communication status of the BTC main chain for on-chain applications to access. Therefore, users can view all inscription market information on LumiBit without having to consult each trading market or indexer separately.

One of the major challenges in current Layer 2 transactions is the inefficiency and cost associated with frequent cross-chain transfer of assets. During transactions on LumiBit, the cross-chain transfer of Bitcoin mainnet assets and the confirmation on the LumiBit chain occur separetely, meaning on-chain transactions can be asynchronously mapped.

Technically, LumiBit’s UTXO Channel Bridge uses UTXO to record user status and combines root proof status encryption with hash time-locked contracts for cross-chain channel validation. This validation is then imprinted on UTXO after the channel closes, ensuring the integrity of data on the Bitcoin network.

This means users can conduct inscription trades directly on the LumiBit network, and after settlement on the LumiBit network, it automatically executes cross-chain operations for the users.

Of course, LumiBit is not without its challenges. The transition from Type2 ZK-EVM to Type1 ZK-EVM presents numerous technical hurdles to overcome. However, it is indisputable that LumiBit exhibits a unique industry-wide perspective. By harnessing impressive technical capabilities, it integrates the leading and mainstream protocols available in the market into an exclusive solution.

LumiBit outlines one of the potential directions for the future development of Bitcoin’s Layer 2, while also depicting a vision of an evolved Bitcoin ecosystem characterized by a comprehensive chain ecosystem and interoperability, without adding to users’ learning curve. We are now on the cusp of the Bitcoin ecosystem explosion as envisioned by LumiBit.

![]()

PrimeXTB

Explore →

![]()

DeGate

Explore →

![]()

iTrustCapital

Explore →

![]()

Coinbase

Explore →

![]()

UpHold

Explore →

Explore more

The post In-Depth Analysis of the Native Bitcoin Layer 2 Network LumiBit appeared first on BeInCrypto.

All credit goes to the original author and article which can be read here:

https://beincrypto.com/in-depth-analysis-of-the-native-bitcoin-layer-2-network-lumibit/